Introduction to NodeAtom

NodeAtom is a next-generation trading ecosystem tailored for both retail and institutional traders. At its core, NodeAtom merges artificial intelligence, advanced technical indicators, and real-time signal generation into a unified platform that empowers users to trade with clarity, precision, and confidence.

Whether you're a beginner looking to learn or a seasoned trader aiming to optimize your strategy, NodeAtom offers a suite of tools that adapts to your needs. From AI-enhanced indicators and risk-controlled strategies to automation-ready alerts, NodeAtom is built to remove guesswork and enhance decision-making.

The platform emphasizes transparency, community collaboration, and performance-driven design. It’s more than a tool—it’s a movement toward smarter, data-driven trading in a world that moves fast and never waits.

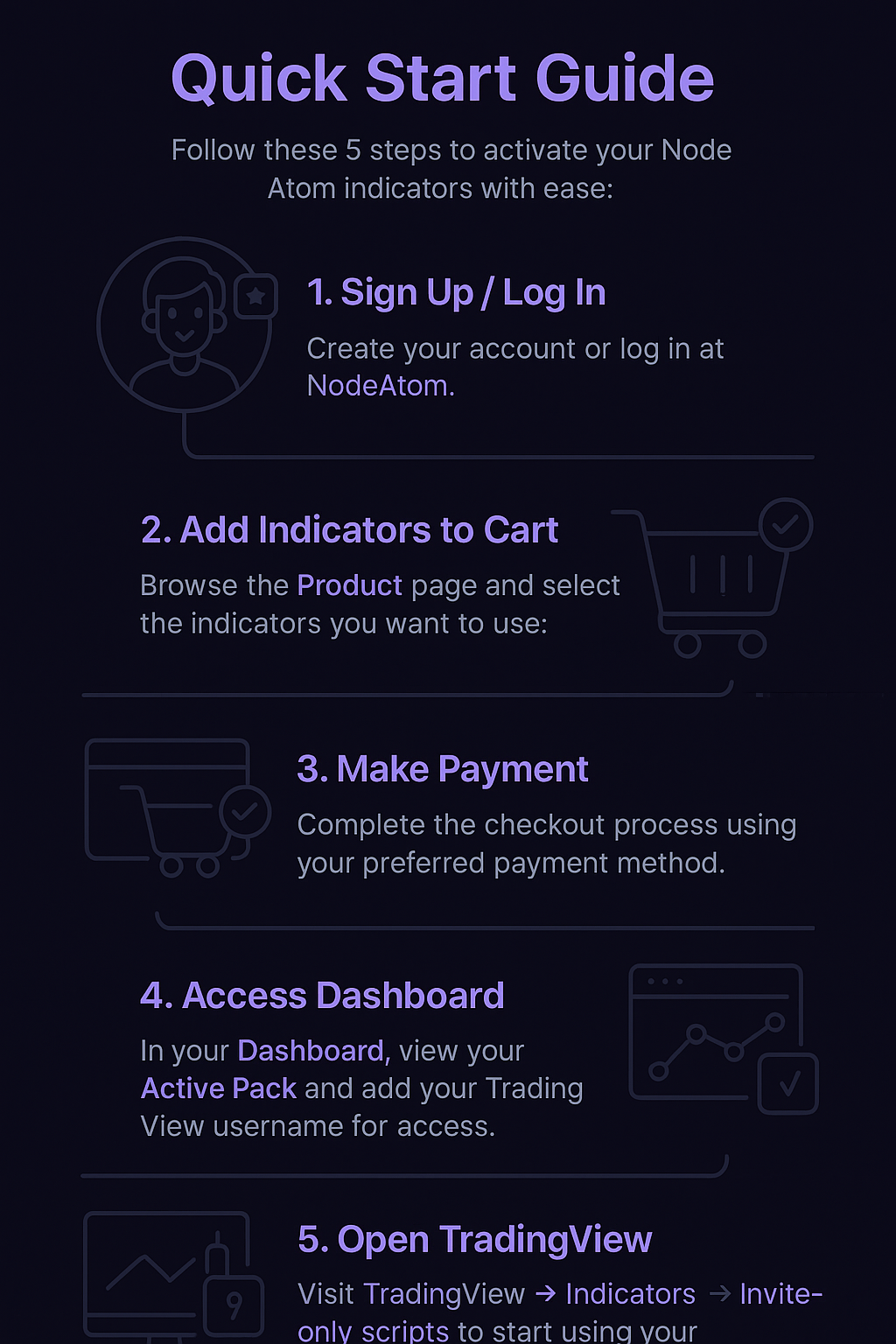

Quick Start Guide

Follow these steps to get started with NodeAtom's trading tools. The process is simple and streamlined to help you access and activate your indicators quickly:

- Sign up / Log in: Create a NodeAtom account or log in if you already have one.

- Browse and select your indicators: Visit the Products page, choose your desired indicators, and add them to your cart.

- Complete payment: Proceed to checkout and securely complete your purchase.

- Access your Dashboard: After payment, go to your Dashboard to view your active packs. Here, enter your TradingView username for access.

- Activate in TradingView: Open TradingView, go to the Indicators section, and find NodeAtom indicators under the “Invite-only scripts” tab.

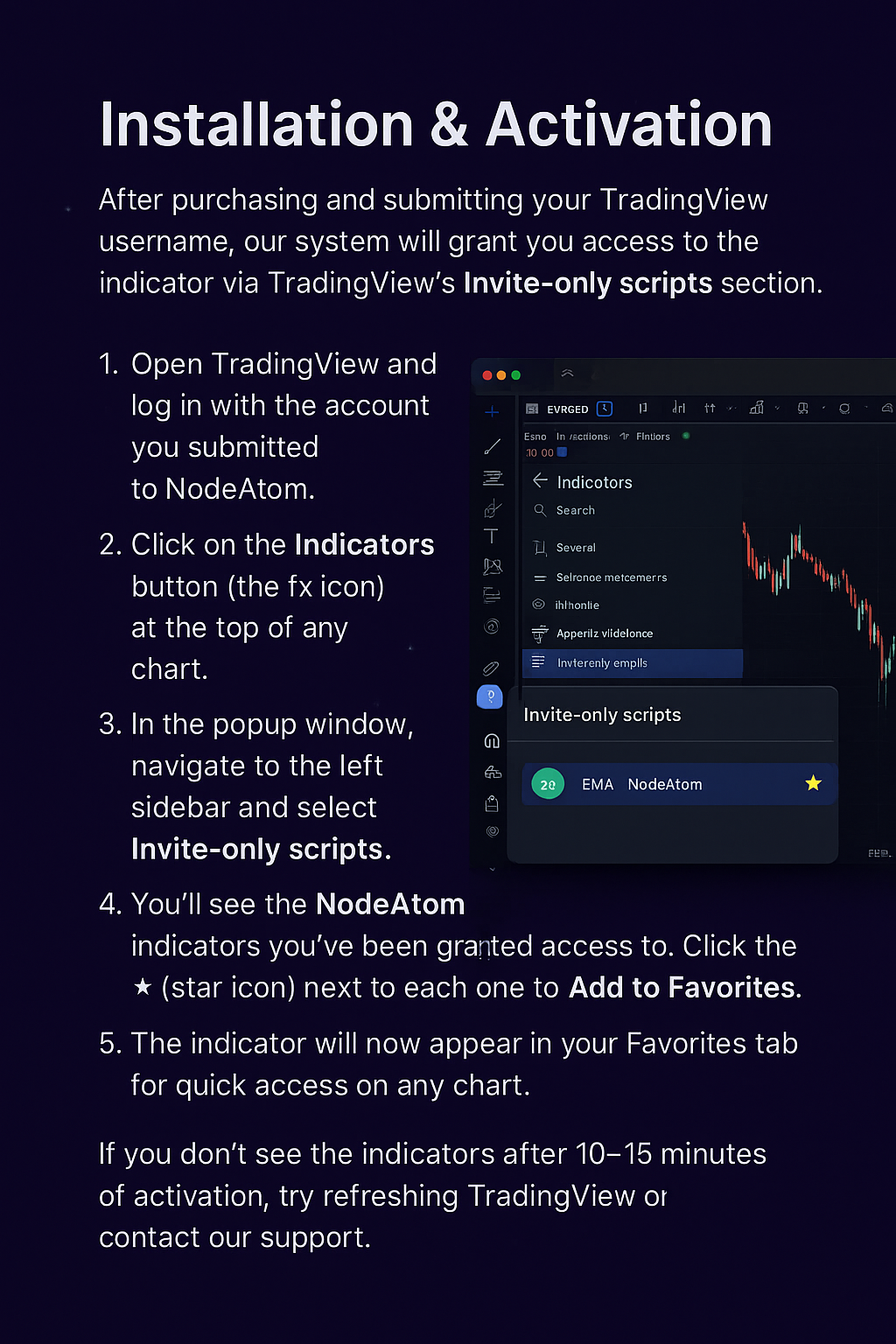

Installation & Activation

After purchasing and submitting your TradingView username, our system will grant you access to the indicator via TradingView’s Invite-only scripts section.

- Open TradingView and log in with the account you submitted to NodeAtom.

- Click on the Indicators button (the fx icon) at the top of any chart.

- In the popup window, navigate to the left sidebar and select Invite-only scripts.

- You’ll see the NodeAtom indicators you’ve been granted access to. Click the ★ (star icon) next to each one to Add to Favorites.

- The indicator will now appear in your Favorites tab for quick access on any chart.

If you don’t see the indicators after 5–10 minutes of activation, try refreshing TradingView or contact our support.

Illustration: Accessing Invite-only scripts & Adding to Favorites on TradingView

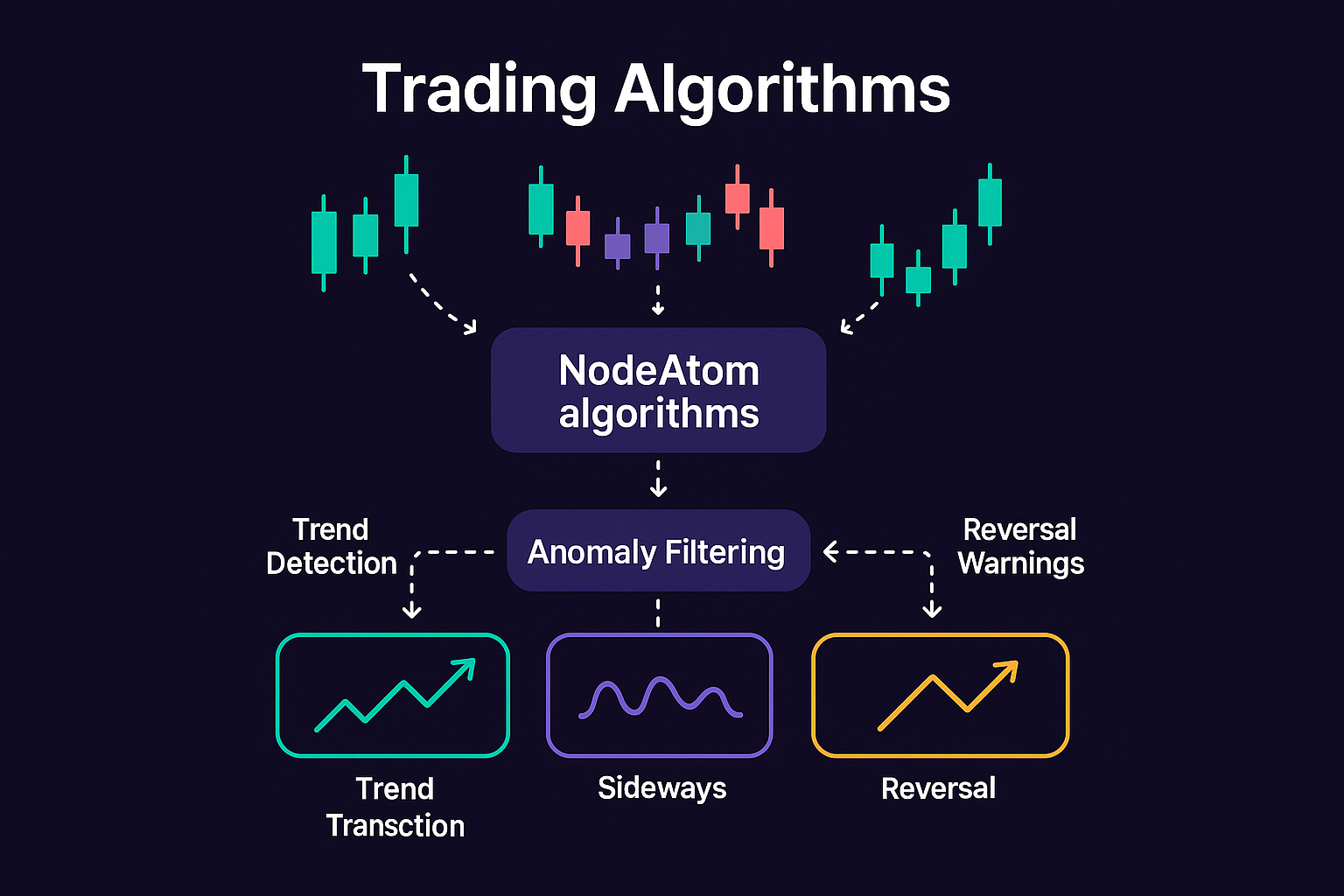

Trading Algorithms

NodeAtom’s algorithms are the core of its trading intelligence—built to help traders identify trends, detect anomalies, and enter trades with greater precision and confidence.

These proprietary systems are designed from real-world trading logic and statistical modeling, optimized for use in live market conditions. Every algorithm is engineered to reduce noise, adapt to different market phases, and provide clear, timely signals.

Core Capabilities:

- Trend Detection: Identify valid bullish/bearish phases across timeframes.

- Reversal Warnings: Detect potential top/bottom zones or trap setups.

- Anomaly Filtering: Remove low-probability signals in sideways markets.

- Multi-Timeframe Logic: Sync entries with higher timeframe direction for increased accuracy.

Custom Parameters:

Traders can fine-tune each algorithm’s behavior—such as signal sensitivity, risk tolerance, confirmation layers, and breakout aggressiveness. This ensures the tools fit your strategy, whether you scalp or swing.

Where It's Applied:

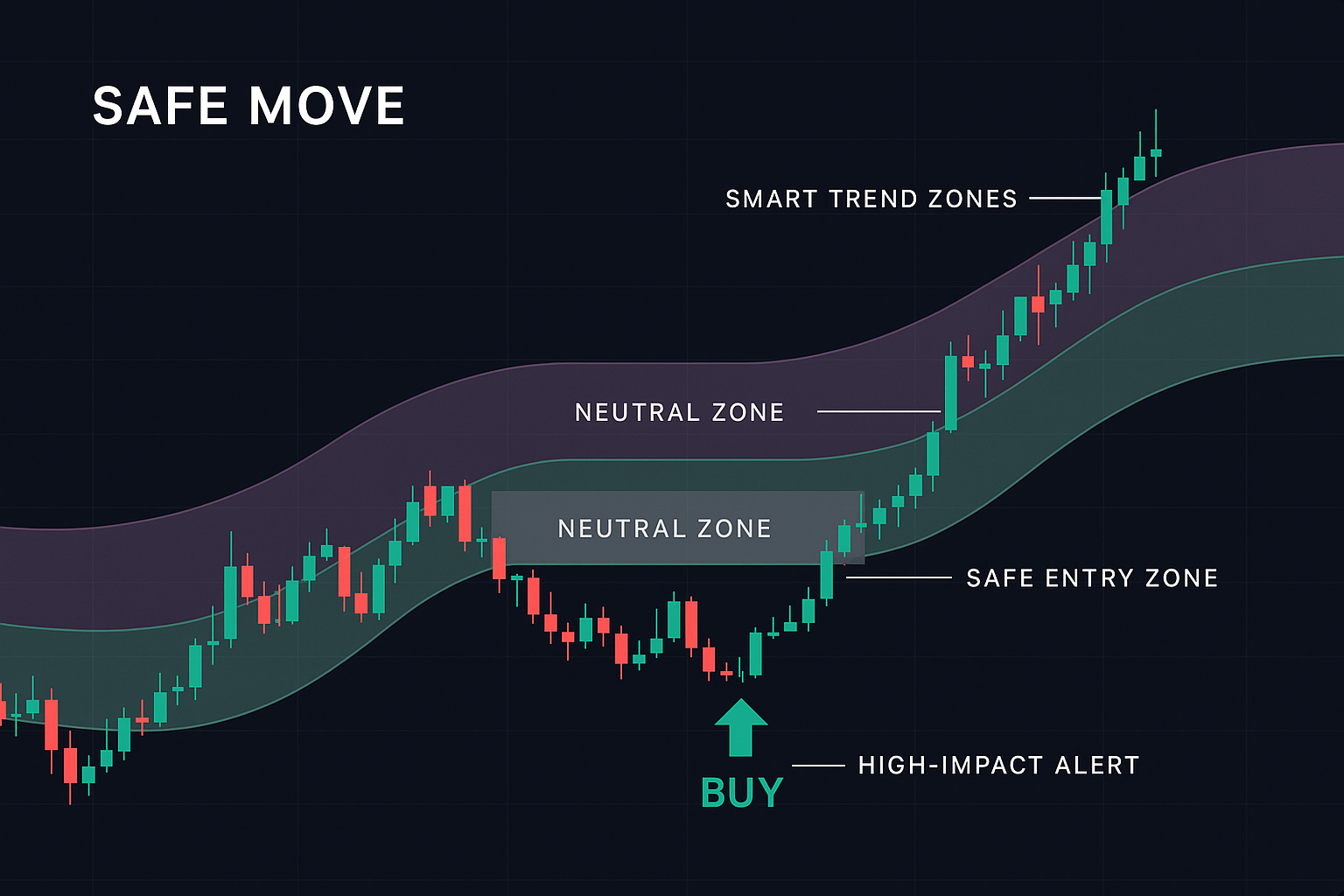

- Safe Move: Filters out neutral zones for clean trend entries.

- Sniper: Detects micro-breakouts and candle momentum shifts.

- Mind Over Market: Predicts trap zones based on market structure.

- Trillion Move: Confirms macro trend direction from multiple timeframes.

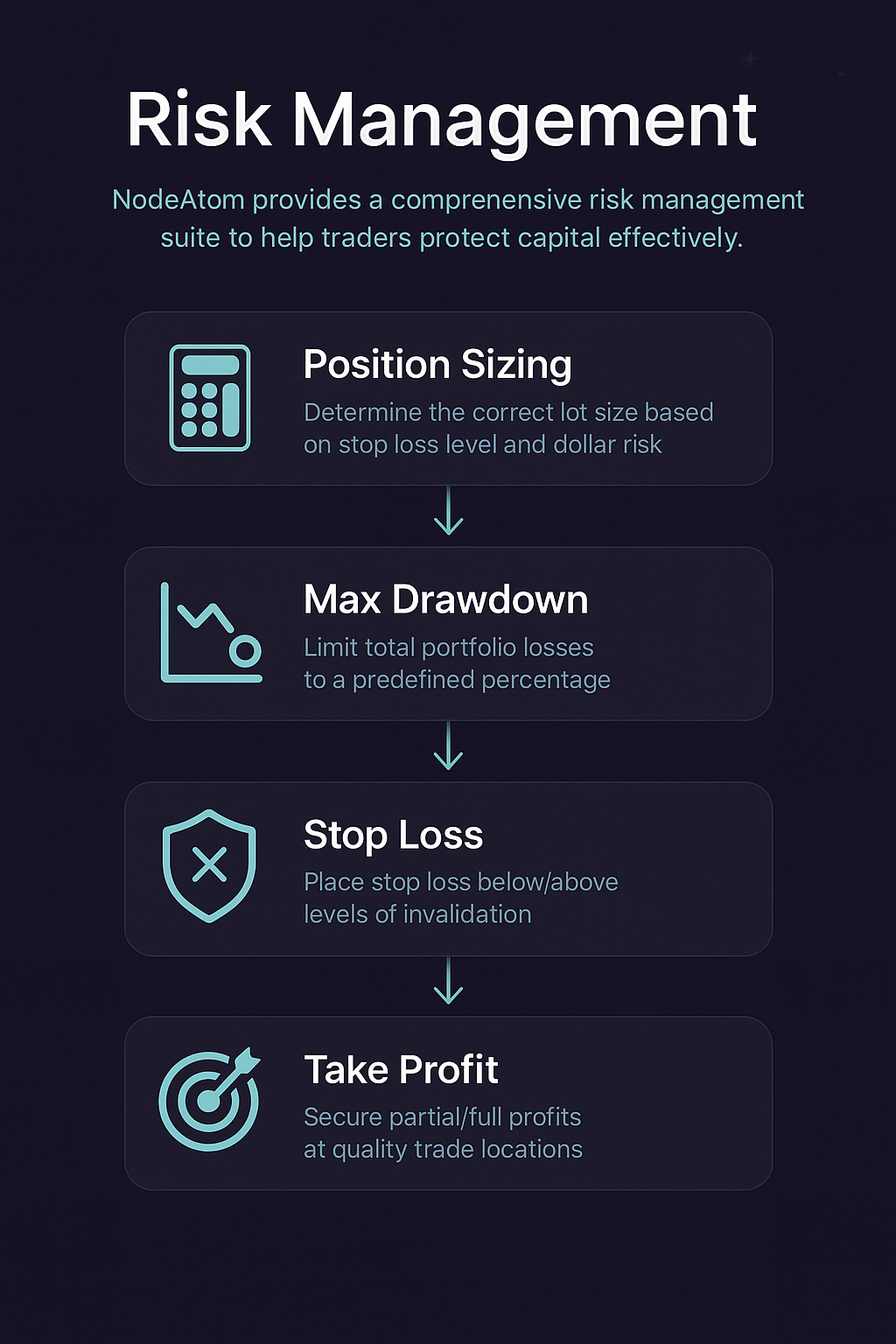

Risk Management

Effective risk management is essential for long-term trading success. At NodeAtom, we incorporate several built-in tools and methodologies to help traders protect capital, manage exposure, and trade more consistently with confidence.

Key Risk Management Features:

- Position Sizing Calculator: Automatically suggests optimal lot size based on your account balance, preferred risk percentage, and stop-loss distance.

- Dynamic SL/TP Zones: NodeAtom indicators suggest stop-loss and take-profit zones based on volatility and structure—not guesswork.

- Drawdown Alerts: Get notified when trade or session loss reaches a predefined percentage to avoid emotional decisions or overtrading.

- Risk-to-Reward Evaluation: Tools help you evaluate if a setup has acceptable R:R ratio before entry.

- Neutral Zone Filters: Most indicators avoid entries in choppy or high-reversal zones, reducing exposure to unpredictable moves.

Best Practices:

- Risk no more than 1–2% of your capital per trade.

- Set fixed SL and never widen it emotionally during a loss.

- Use session limits (max 2–3 trades/day) to avoid revenge trading.

- Review performance weekly and adjust risk if hitting consecutive losses.

- Use NodeAtom’s Break-Even tools to protect profit once trade reaches +1R.

Whether you're scalping or swing trading, our risk management modules are designed to align with your strategy and psychology—so you can stay in the game longer and smarter.

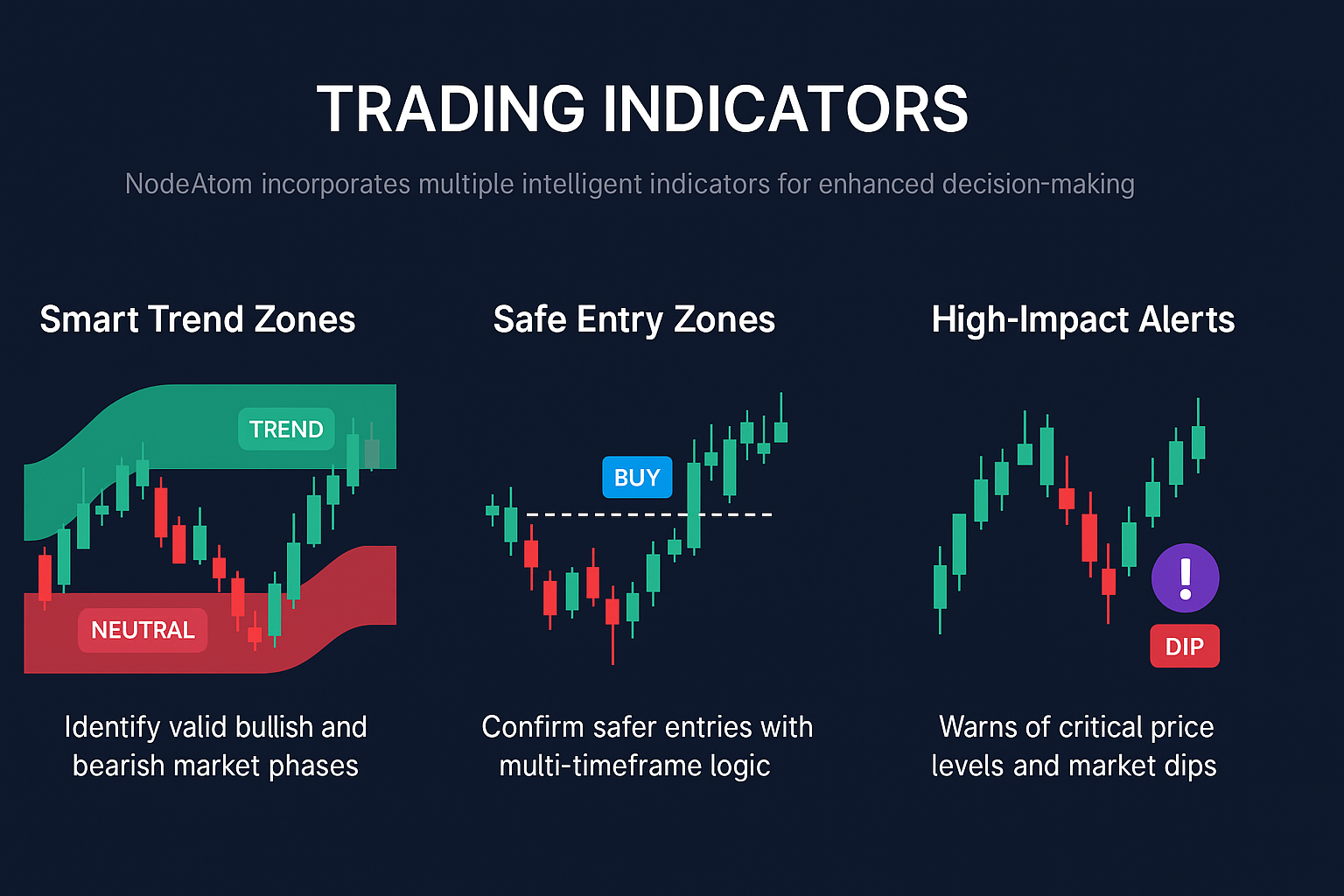

Indicators

NodeAtom’s indicators are engineered to combine clarity, efficiency, and predictive power—offering traders actionable insights without unnecessary noise. Whether you're scalping or swing trading, each tool is built to adapt to your strategy and market conditions.

Key Components:

- Smart Trend Zones: Automatically highlight trending areas while filtering out sideways, neutral, or risky conditions.

- Safe Entry Signals: Color-coded signals (e.g., Green for BUY, Pink for SELL) that appear only when trend alignment and volume criteria are met.

- Reversal Alerts: High-probability warning zones based on market structure and exhaustion patterns.

- Support & Resistance Zones: Dynamic zone mapping updated in real-time for accurate target placement and stop-loss positioning.

- Volatility Filter: Prevents false signals in high-noise markets or during consolidation phases.

- Multi-Timeframe Sync: Aligns signals with higher timeframe trends (M1–D1) for improved accuracy and confirmation.

Available Indicators:

- Safe Move: Trend-following indicator that filters out neutral zones and reduces risky entries.

- Sniper: Precision breakout detector with early-entry signals and micro momentum detection.

- Mind Over Market: Institutional-level structure analysis with smart trap detection.

- Trillion Move: High-timeframe confirmation tool for macro trend direction and trade filtering.

All NodeAtom indicators are accessible via TradingView and include real-time updates, customizable settings, and invite-only access once your account is approved.

Visual: How NodeAtom indicators combine clarity and timing across markets.

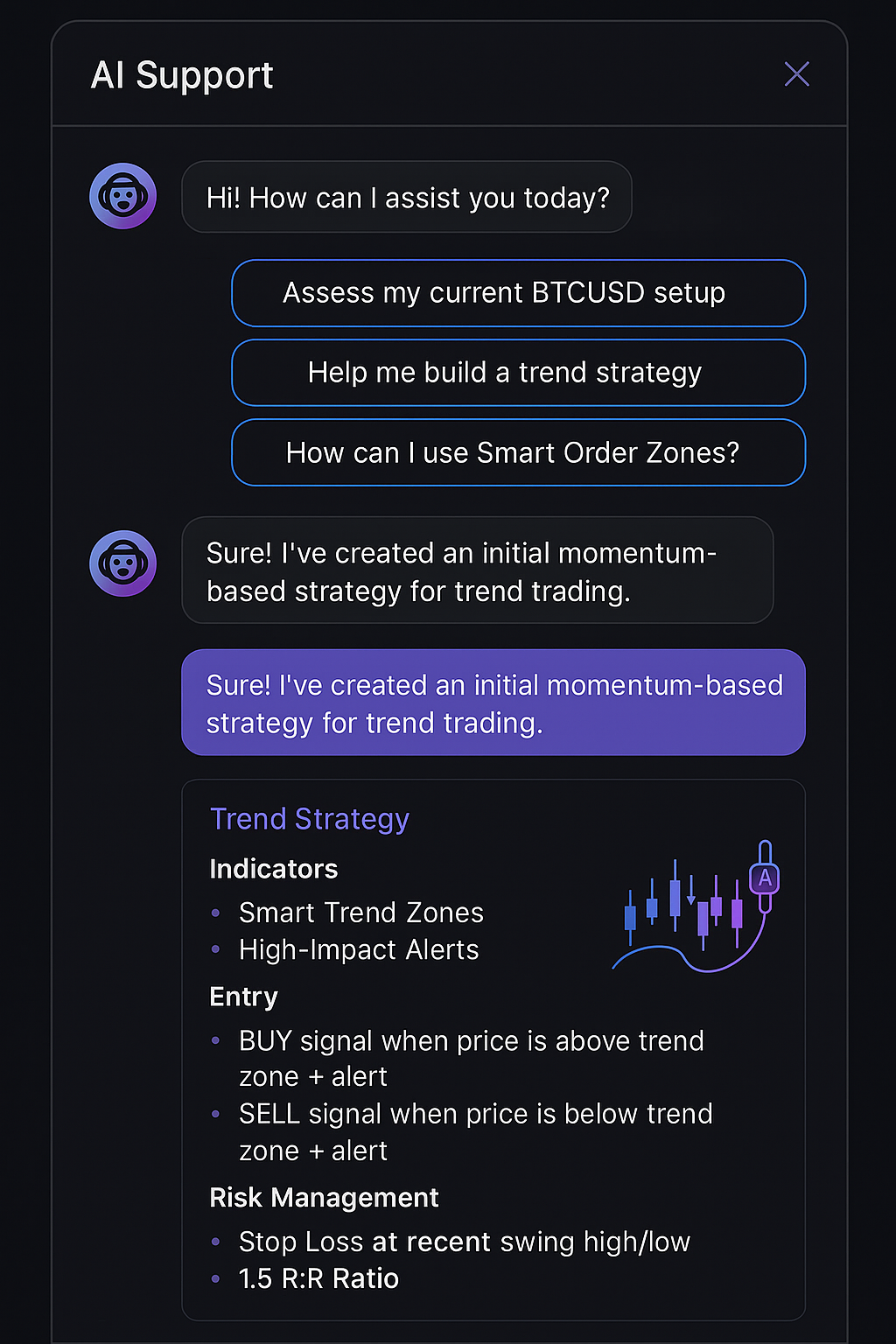

AI Support

NodeAtom's AI Support system is designed to assist traders across every stage of their journey—from planning strategies to interpreting real-time signals. Leveraging conversational AI and integrated data analytics, it reduces guesswork and enhances decision-making with instant, intelligent guidance.

What AI Support Can Do:

- Strategy Assistant: Input your trading preferences and receive optimized setups and risk-adjusted plans.

- Signal Explainer: Ask the AI to explain why a BUY or SELL signal was triggered, with reference to trend, structure, and confirmation.

- Indicator Usage Help: Get guidance on configuring indicator settings based on your goals (scalping, swing, trend-following, etc.).

- Knowledge Base + FAQ: Search and ask questions about NodeAtom tools, features, and trading theory—directly from the platform.

- Risk Optimization: AI recommends SL/TP zones based on historical setups and your current strategy profile.

How to Use AI Support:

- Go to your Dashboard and access the AI Support tab.

- Start a chat or select a guided template (e.g., “Build a Trend Strategy”, “Analyze My Setup”).

- Receive real-time suggestions, charts, and editable strategy logic.

- Use the recommendations or export them into alerts or notes directly into TradingView.

Whether you're a beginner looking for confidence or a pro refining your edge, NodeAtom AI is like having a trading assistant available 24/7—trained on real trader behavior, not theory.

Illustration: Conversational AI guiding live strategy refinement and indicator optimization

Webhooks & Automation

Easily link TradingView alerts to automation platforms like Zapier, Discord, or MetaTrader via webhook URLs.

Frequently Asked Questions

Coming soon...

Safe Move Strategy

The Safe Move strategy focuses on identifying clear market trends and avoiding noisy or sideway zones. It is ideal for traders who prefer safer entries using multi-timeframe confirmation.

Entry Rules

- BUY: Green signal appears, not in NEUTRAL zone, larger timeframes (M15/H1/H4) also bullish, and price not too far from support.

- SELL: Pink signal appears, not in NEUTRAL zone, larger timeframes (M15/H1/H4) also bearish, and price not too far from resistance.

- Never enter in NEUTRAL zones due to high reversal probability.

Stop Loss & Take Profit

- Option 1 - R:R Ratio: At least 1:1, ideally 1:1.5 or 1:2 in strong trends.

- Option 2 - Price Zones: TP just before next resistance (BUY) or support (SELL).

- Use Sniper, MindOverMarket, or Trillion Move to refine TP zones.

Trade Management

- Move SL to break-even once trade reaches 1R profit.

- Optionally take 50% at TP1 and let the rest run.

Suggested Timeframes

- Fast Scalping: M1 – M5

- Stable Trading: M15 – H1

- Trend Confirmation: H1 – H4 – D1

Summary Principles

- Only enter valid signals that align with trend and timing.

- Do not force trades – wait for quality setups.

- Have clear TP/SL – remove emotional decisions.

Sniper Strategy

Sniper is a short-term strategy tool ideal for scalpers and intraday traders. It detects high-probability entries using EMA crossovers and precise candle signals.

Signals & Interface

- Green EMA: EMA9 (short-term trend)

- Yellow EMA: EMA34 (longer-term trend)

- BUY Signal: “BUY” label at candle low when EMA9 is above EMA34

- SELL Signal: “SELL” label at candle high when EMA9 is below EMA34

- Warning (X): Pre-alert before confirmation

Trade Rules

- Trade only in the direction of the trend based on EMA crossovers

- Avoid trading during NEUTRAL zones (when two EMAs are close)

- Do not enter when market is choppy or lacks direction

Take Profit & Stop Loss

- TP: Recommended 1:1 to 1:1.5, extendable in strong trends

- SL: Place below recent low for BUY, above recent high for SELL

Timeframes & Timing

- Best Timeframes: M1 – M5 – M15

- Avoid: High-volatility news (e.g. NFP, FOMC), US/London session open, Monday morning, Friday night

Suggested Combinations

- Safe Move: Helps avoid NEUTRAL zones

- Trillion Move: Confirms overall trend

- MindOverMarket: Detects potential top/bottom zones

- Optional: Use semi-auto EA for instant SL/TP management post-entry

Mind Over Market Strategy

The Mind Over Market (MoM) strategy is designed to help traders anticipate market psychology, liquidity grabs, and institutional traps. It focuses on identifying potential top and bottom formations where reversals are likely.

Key Concept

- MoM identifies trap zones where liquidity may be taken before a reversal occurs.

- Best used when price has hit key zones like support/resistance or after fake breakouts.

- Can be combined with other indicators like Safe Move for confirmation.

MoM Signal Interpretation

- Top Trap (RED): Price likely faked out to the upside — look for potential SELL setup.

- Bottom Trap (GREEN): Price likely faked out to the downside — look for potential BUY setup.

- NEUTRAL: Avoid trading unless confirmed by external signal.

Entry Guidelines

- Wait for confirmation candle after MoM signal.

- Use higher timeframe context — if H1 shows trap at resistance, lower timeframes may align better.

- Avoid trading MoM signals blindly — look for confluence with trend or S/R levels.

Stop Loss & Take Profit

- SL above recent wick (SELL) or below wick (BUY) of trap candle.

- TP at next key support/resistance or fixed R:R (1:1.5 or 1:2 preferred).

Best Use Cases

- Reversal Trading: Ideal for timing potential market tops and bottoms.

- Trap Detection: Avoids entering into false breakouts.

- Smart Exit: Can be used to close trend trades when reversal signal appears.

Trillion Move Strategy

Trillion Move is a macro-level trend detection indicator designed to provide a high-level view of market direction across multiple timeframes. It is used to confirm whether the market is in a clear bullish or bearish trend, helping traders avoid sideways or uncertain conditions.

Purpose & Strengths

- Identify dominant trend direction based on M15, H1, H4, D1 timeframes.

- Support decision-making for entries and exits by showing macro alignment.

- Filter out false signals from local indicators.

How to Use

- If Trillion Move shows all major timeframes as BULLISH → prioritize BUY setups.

- If all are BEARISH → prioritize SELL setups.

- If mixed or unclear → stand aside or wait for confirmation.

Best Practice Combinations

- Combine with Safe Move to avoid NEUTRAL zones and reduce risk.

- Use with Sniper for optimized entry timing after macro confirmation.

- Confirm with MindOverMarket for turning points or DIP zones.

Timeframes

- Macro Direction: H1 – H4 – D1

- Micro Entries: M1 – M5 (after trend confirmation)

Key Notes

- Never counter-trade against all-timeframe signals from Trillion Move.

- Use it as your first check before placing trades in any other strategy.

- Helps you stay with the trend and avoid chop zones.

Combination Strategy: Safe Move + Sniper + Mind Over Market

Combining multiple indicators allows traders to gain a more holistic, high-confidence view of the market. This NodeAtom strategy merges the trend-following accuracy of Safe Move, the precision timing of Sniper, and the structural insight of Mind Over Market to provide entry, confirmation, and exit logic.

1. Confirm the Trend with Safe Move

Use Safe Move to identify the market's directional bias and avoid choppy/neutral zones.

- Only trade in the direction of the Safe Move trend (Green for BUY, Pink for SELL).

- Avoid trading when Safe Move signals NEUTRAL or conflicting trends across timeframes.

2. Entry Timing with Sniper

After the Safe Move confirms trend, wait for Sniper to trigger a micro breakout or momentum shift in the same direction.

- BUY: Sniper signal aligns with Safe Move bullish zone.

- SELL: Sniper signal aligns with Safe Move bearish zone.

- Entry is valid only if both indicators agree on trend direction.

3. Exit Signals with Mind Over Market

Mind Over Market identifies market traps and exhaustion zones. Use it to anticipate potential reversals and exit partially or fully.

- DIP (Red on Top of Candle): Consider partial/full TP if price hits structural resistance with a bearish DIP.

- DIP (Green Below Candle): If long, avoid exiting too early if a green DIP confirms support.

- Use these signals in tandem with R:R-based TP zones and volume confirmation.

Example Strategy Flow:

- Safe Move shows a bullish trend (Green zone + higher timeframe agreement).

- Sniper gives a BUY signal above support → enter trade.

- Mind Over Market prints a DIP at a structural high → reduce position or take full profit.

Suggested Timeframes

- Scalping: Safe Move on M5, Sniper on M1, MoM on M15

- Day Trading: Safe Move on M15, Sniper on M5, MoM on H1

- Swing Trading: Safe Move on H1/H4, Sniper on M15/H1, MoM on D1

This tri-indicator strategy maximizes confluence by aligning trend, timing, and exit awareness. Practice in demo mode to master timing and adjust parameters for your preferred trading style.

Visual: Safe Move + Sniper + Mind Over Market synergy across trend, entry, and exit

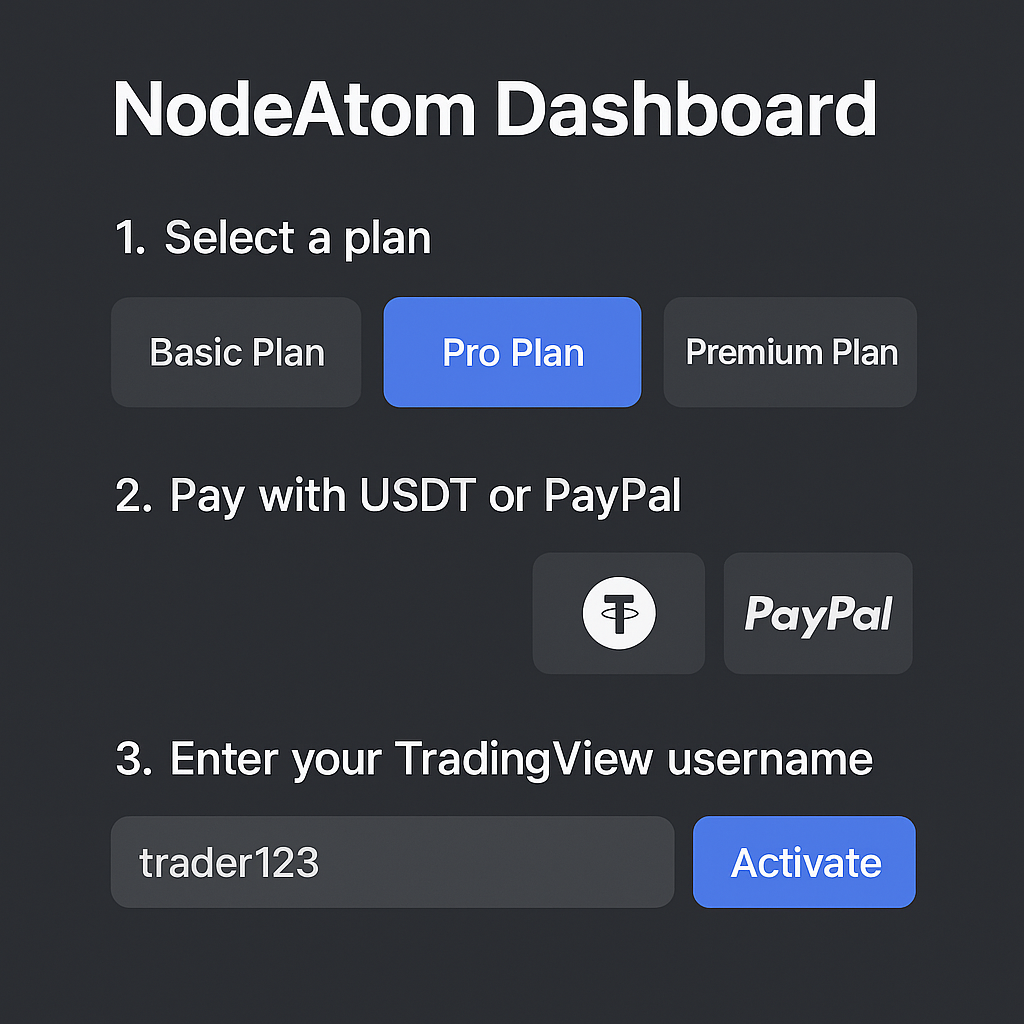

Payment & Plans

NodeAtom supports two convenient payment methods to activate premium indicators on TradingView.

Available Payment Methods

- USDT (TRC20 or BEP20): Fast and secure crypto payments.

- PayPal: Use your PayPal balance or credit card.

How to Activate

- Log in to your NodeAtom Dashboard.

- Select your desired plan and complete the payment using USDT or PayPal.

- After payment, go back to the Dashboard and enter your TradingView username.

- Activation is automatic — you’ll get access via TradingView's Invite-only Scripts shortly.

If you don't see access after 5–10 minutes, refresh TradingView or contact support.

Free Access Program

You can gain free access to premium NodeAtom indicators through our official referral program!

How to Qualify

- Register a trading account on a supported exchange (e.g., Exness, Exness) using a NodeAtom partner code.

- Email us with the following details:

- The email used to register on the exchange

- The exchange name

- Your TradingView username

Send to

Please send an email with the subject "Free Access Request" to support@nodeatom.ai.

Important Notes

- The exchange account must be newly created under the NodeAtom partner link.

- Verification may take 24–48 business hours.

- Once verified, you will receive free access to the designated indicators.

This program is a great opportunity to explore our premium tools at no cost.